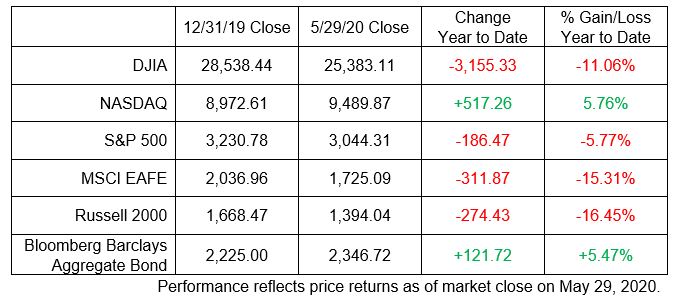

Stocks continued to move higher in May, as the S&P 500 rallied for a second consecutive month. Continued stimulus from fiscal and monetary authorities has boosted equities, bolstering expectations for an economic rebound later this year and into early 2021. However, positive equity headlines don’t tell the full story, cautions Raymond James Chief Investment Officer Larry Adam.

While he expects equities to be higher over the next 12 to 24 months, near-term risks include rising geopolitical tensions with China as well as potential setbacks related to COVID-19. It helps that mitigation measures have the number of new cases, hospitalizations and the percentage of positive tests trending in the right direction.

We thought we’d share a high-level summary for now, but you can always read the full market letter for more details on the latest economic data and U.S.-China relations.

- Recent economic data continues to reflect the record decline we’ve seen so far in 2020, including unprecedented job losses and declines in consumer spending. A full recovery could take several quarters.

- The rally in U.S. growth equities has been primarily driven by a handful of companies that have benefited from heavy exposure to technology and the work-from-home environment.

- Despite some headwinds, the equity markets still made progress in May. However, long-term opportunity for an ensuing bull market remains.

Investing involves risk, and investors may incur a profit or a loss. All expressions of opinion reflect the judgment of Raymond James and are subject to change. Economic and market conditions are subject to change. The Dow Jones Industrial Average is an unmanaged index of 30 widely held stocks. The NASDAQ Composite Index is an unmanaged index of all common stocks listed on the NASDAQ National Stock Market. The S&P 500 is an unmanaged index of 500 widely held stocks. The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. The Russell 2000 is an unmanaged index of small cap securities. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. An investment cannot be made in these indexes. Material prepared by Raymond James for use by its advisors