While factors including the partial government shutdown and trade policy uncertainty brought us into the New Year with increased downside risks, February seemed more promising, points out Raymond James Chief Economist Scott Brown: a potential U.S.-China trade agreement appeared on the horizon and the United Kingdom is considering a revote on Brexit. The government shutdown is also behind us; however, the national emergency declaration could inject new uncertainty. According to Brown, the economic outlook is less clouded, but the pace of growth is still expected to be slower in 2019, largely reflecting the fading impact of fiscal stimulus.

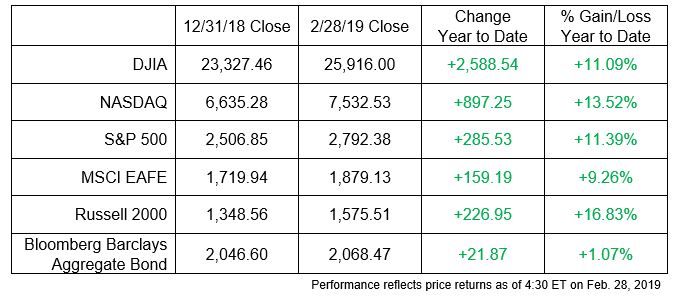

For the month of February, the S&P 500, Dow Jones Industrial Average, NASDAQ and Russell 2000 Index ended up in positive territory.

Here are some of the latest movements in the economy and global markets that have our attention:

Economy

- Recent data releases – some of which were delayed due to the government shutdown – have been mixed, but job and wage growth should be supportive for consumer spending growth, shares Brown. The recent retreat in mortgage rates should help housing activity into the important spring season.

- The Federal Reserve shifted from a mild tightening bias in mid-December to a seemingly neutral policy stance in late January. Many Fed officials believe it may be appropriate to nudge short-term interest rates higher if the economy evolves as expected; however, it’s unlikely to take action in the next six months, said Nick Lacy, chief portfolio strategist for Raymond James Asset Management Services.

- Fed officials had been discussing the balance sheet in 2018 and announced in January that the unwinding will likely end sooner and at a higher level than was expected earlier.

- President Trump’s meeting with Chinese President Xi, tentatively scheduled for spring, may provide a market boost for both countries if they achieve meaningful progress on trade.

Equities

- The S&P 500 has continued to grind higher, now up 19% in the roughly two months since the Christmas Eve low. The rally has been very impressive and there have been only two down days of over 1%, which were quickly reversed, points out Joey Madere, senior portfolio strategist, Equity Portfolio & Technical Strategy.

- Fourth quarter earnings season is winding down; 72% of companies that have reported have beaten estimates by an average of 3.4%. The highest percentage of beats came from industrials, healthcare and technology; and the best earnings surprises came from communication services, consumer discretionary, technology and healthcare, according to Madere.

- Lacy favors defensive large-cap companies over growth-oriented ones at the moment, although small caps outperformed most other equities in recent weeks.

Fixed income

- Right now, the net flow of asset transfers is into high quality, safe-haven assets, shares Doug Drabik, Managing Director Fixed Income Research. Maintaining a balanced allocation to offset against potential portfolio swings is very important during in times of volatility, he explains. He adds that individual bonds present one of the few “hedges” to growth assets, such as equities, as fixed income with moderate to longer duration are negatively correlated to those growth assets.

- Lacy and his team similarly favor high-quality bonds given current conditions. The prospect of a steepening yield curve has them recommending some exposure to shorter-duration bonds, as well.

- Credit spreads garnered attention after rising sharply the last quarter of 2018. Despite the sharp rise, credit spreads are largely in line with their five-year averages, Drabik reports.

International

- The generally positive climate for global investments continued in February, aided by positive noises out of the global trade discussions between the U.S. and China.

- There was less overt progress on other pressing issues, such as controlling rising European political populism and encouraging dynamism-enhancing reform legislation. These are particularly impacted by slowing global economic growth, which has increased the potential for stimulus efforts by governments and some central banks in Europe and Asia, reports European Strategist Chris Bailey.

- Talk of Brexit compromises have increased, leading to some recovery strength in the British pound during late February.

- Germany avoided falling into recession and both the Chinese and Brazilian authorities continue to talk reform.

- Valuations for global markets remain on average lower and also typically offer higher dividend yields than U.S. securities.

Bottom line

- Madere takes a constructive view of the markets over the next year or so, but cautions investors to be patient when looking for purchase opportunities, given what he views as overbought conditions.

- We continue to encourage investors to focus on high-quality bond and equity positions that align with their long-term goals and financial plan.

Investing involves risk, and investors may incur a profit or a loss. All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates, Inc., and are subject to change. Past performance is not an indication of future results and there is no assurance that any of the forecasts mentioned will occur. The process of rebalancing may result in tax consequences. Economic and market conditions are subject to change. The Dow Jones Industrial Average is an unmanaged index of 30 widely held stocks. The NASDAQ Composite Index is an unmanaged index of all common stocks listed on the NASDAQ National Stock Market. The S&P 500 is an unmanaged index of 500 widely held stocks. The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. The Russell 2000 is an unmanaged index of small cap securities. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. An investment cannot be made in these indexes. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small and mid-cap securities generally involve greater risks. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification. The performance noted does not include fees or charges, which would reduce an investor’s returns. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Debt securities are subject to credit risk. A downgrade in an issuer’s credit rating or other adverse news about an issuer can reduce the market value of that issuer’s securities. When interest rates rise, the market value of these bonds will decline, and vice versa. U.S. Treasury securities are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. The yield curve is a graphic depiction of the relationship between the yield on bonds of the same credit quality but different maturities. Chris Bailey is with Raymond James Euro Equities, an affiliate of Raymond James & Associates, and Raymond James Financial Services. Material prepared by Raymond James for use by its advisors.

Securities offered through Raymond James Financial Services, Inc., member FINRA/SIPC.

© 2019 Raymond James Financial Services, Inc., member FINRA/SIPC. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc.

Raymond James Financial Services does not accept orders and/or instructions regarding your account by email, voice mail, fax or any alternate method. Transactional details do not supersede normal trade confirmations or statements. Email sent through the Internet is not secure or confidential.

Raymond James Financial Services reserves the right to monitor all email. Any information provided in this email has been prepared from sources believed to be reliable, but is not guaranteed by Raymond James Financial Services and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational purposes only and does not constitute a recommendation. Raymond James

Financial Services and its employees may own options, rights or warrants to purchase any of the securities mentioned in this email. This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please contact the sender immediately